Peter Vahlefeld — An eye on the market: Clare McAndrew is the founder of Arts Economics, a Dublin-based research and consulting firm, established in 2005, that works with international art fairs, dealers, trade associations, auction houses, and national and transnational public institutions. Here, she speaks with the Quarterly’s Alison McDonald about the intricacies of her art-market research and analysis, detailing the ecosystem behind the business and the inherent challenges of addressing a notoriously opaque and subjective market.

Alison McDonaldWhat do you see as the core elements of the art ecosystem?

Clare McAndrewWell, as an economist, I look at supply and demand as the fundamental components. Supply is represented by artists and demand is represented by collectors and patrons of the arts. But my research often tends to focus on everybody in between, all the different intermediaries.

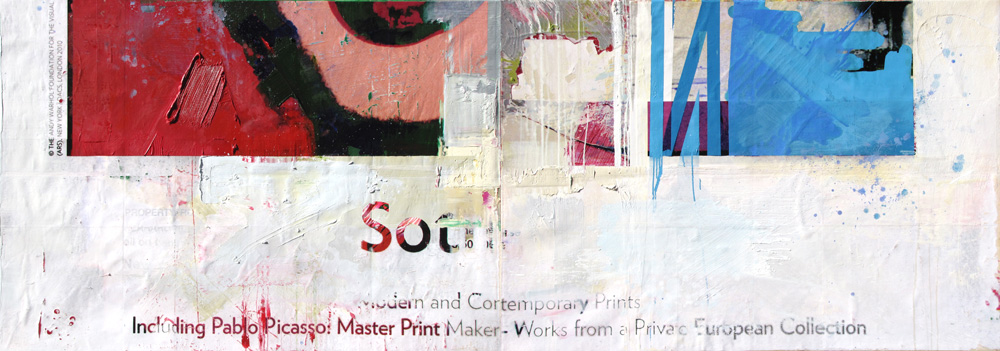

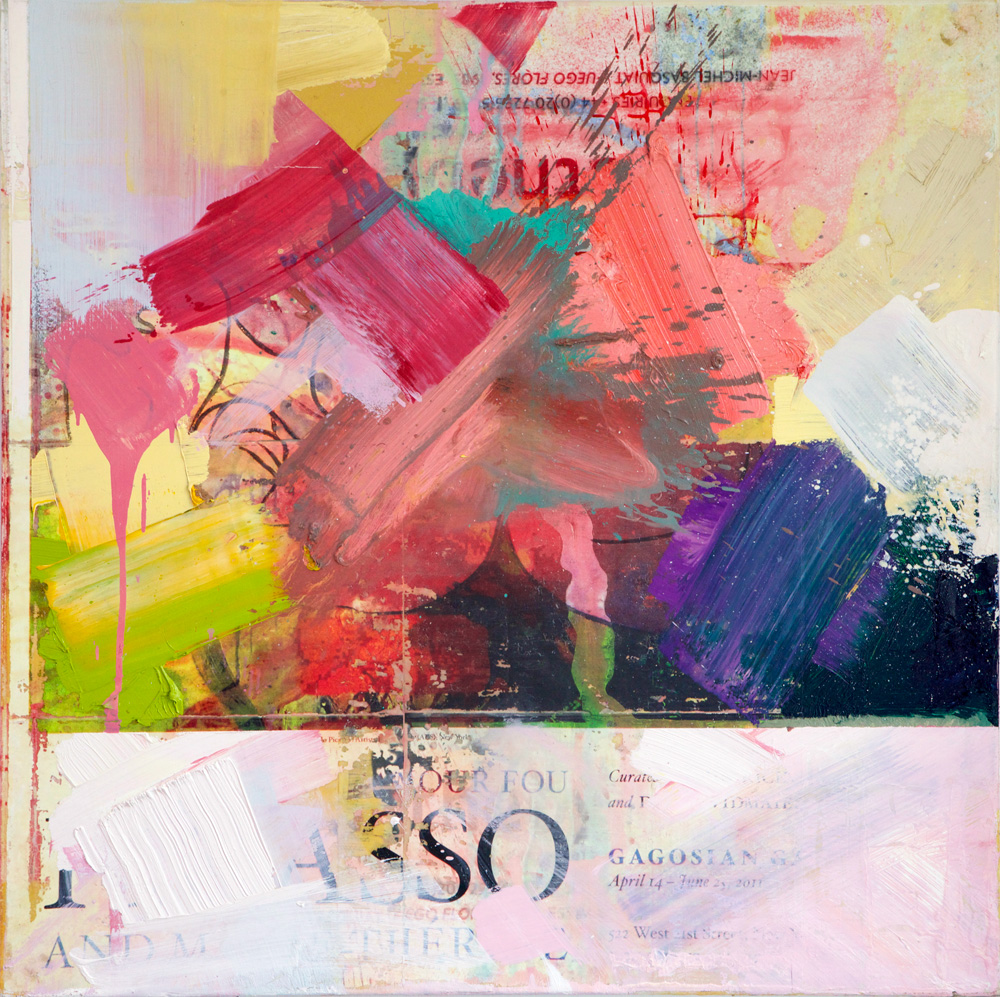

It is the difference of the image to itself which manifests as a tautology and seems to be somewhere in between the real material and its appearance. These media duplications are not just a quote of the over-painting but a repetition of their own mediatisation. What repeats itself is not just the original painting with paint and brush, but the reproduction of this process as a mass-media image where, somewhere between the material trace and the commercial printing, the differences have been lost.

When I first started doing my Art Basel annual art-market report, many years ago, things were simpler: the intermediaries were galleries, dealers, auction houses, and fairs, and that was it. Now there are press agencies, advisors, online initiatives that work with galleries and auction houses, or directly with consumers and artists, and on—a wide range of platforms. The number of intermediaries focused on sales alone has expanded substantially. And then there are all of the information intermediaries—there have always been critics and media, but now there are data providers, financial art advisors, a whole advisory network, and that’s before you even look at events and all the different businesses and experts attached to them.

Something I’ve looked at in my research for institutional clients is the wider economic impact of the art market, and then you get a sense of all the ancillary and side businesses that support it—they’re in the ecosystem, they’re all the support services, logistics, insurance, banking, all those things that are often very niche, specialized services. Some of them wouldn’t exist at all without the art market, such as the specialized appraisers and conservators, but there are also specialized areas of mainstream industries like insurance and banking. One very important intermediary is the government, which can be a little bit of a double-edged sword. On the one hand, the government is a consumer and a supporter of the arts and a very important funder and protector. On the other hand, it has a role in direct and indirect regulation of the art trade, and that doesn’t always have a positive impact. So you have all these systems that interact together, and it’s expanding.

AMcDIt’s fascinating to think about the different roles that governments can play, both directly and indirectly. Perhaps you could elaborate on that, or provide an example?

CMcAThey’re very important. They can provide aid directly, for example by offering subsidies for artists, or they can impact the market indirectly—how they tax the wealthy can stimulate or suppress sales, and regulations that they impose can restrict art exports. So they can be positive or negative. When I started researching the art market, my focus was on artists—I was working for arts councils back then, to suggest ways the government could better support artists’ livelihoods and careers. Some of that research showed how policies can be put into place that won’t necessarily have the impact that the government thinks they will. At the time, governments were looking for alternatives to direct subsidies, but in hindsight we’ve found out that, in a lot of ways, policies like subsidies, which drive supply and encourage a healthy, thriving market, actually work better than trying to interfere with the market’s prices and other mechanisms.

Clare McAndrew